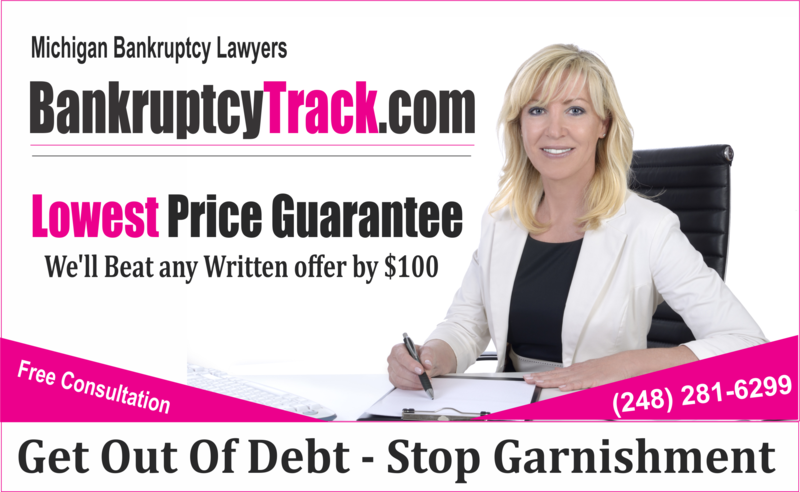

Our Cheap and Affordable Michigan Bankruptcy Lawyers in Detroit represent individual and small business debtors in Chapter 7 and Chapter 13 bankruptcy cases, in all in all counties that are within the United States Bankruptcy Court for the Eastern District of Michigan including Detroit, Ann Arbor, Allen Park, Albion, Lincoln Park, Brighton, Howell, Hamtramck, Harper wood, Royal Oak, Southgate, Romulus, Canton, Southfiled, Saline, Monroe, Blissfield, Romulus, Southgate, Wyandotte, Livonia, Dearborn, Westland, Lansing, East Lansing, Okemos, Warren, Sterling Heights, Roseville, Eastpointe, Battle Creek, Oak Park, Hillsdale, Inkster, Ferndale, Hazel Park, Whitmore Lake, Plymouth, Farmington, Trenton, Flat Rock, Tecumseh, Clinton, Chelsea, Novi, Garden City, Westland, Northville, South Lyon, Milan, Brooklyn, Melvyndale, Ecorse, Belleville, Canton, Wayne County, Ingham County, Washtenaw County, Monroe County, Macomb County, Livingston County, Shiawassee County, Clinton County, Eaton County, Calhoun County, Branch County, Hillsdale. The information contained herein is not legal advice. Any information you submit to us may not be protected by attorney-client privilege. All or some photos shown depict models and may not be actual attorneys or clients. An attorney responsible for the content of this Site is M. Zaher, Esq., licensed in Michigan with offices at 18551 W. Warren Ave., Detroit, Mi. 48228. We are expressly disclaim all liability in respect to actions taken or not taken based on any or all the contents of this website. We reserve the right , at our sole discretion, to change, suspend, or discontinue all or any part of this website or the content at any time without prior notice or liability.

We are a debt relief agency. We help people file for bankruptcy relief under the Bankruptcy Code.

We Are A Michigan Law Firm: Associate Attorneys of Michigan., PLC

Location: 18551 W. Warren Ave ., Detroit, MI. 48228

Tel : 313-982-0010

Toll Free : 1-877-471-4049

Fax : 313-271-2561

Email : Bk@advantalaw.com

Business Hours : M-F From 9:00 AM to 5:00 PM

Detroit

18551 W. Warren Ave.,

Detroit, MI. 48228

(313) 982-0010

Southfield

24300 Southfield Rd, Ste 210

Southfiled, MI. 48075

(248) 281-6299

For your FREE CONSULTATION and to speak with an experienced Michigan Bankruptcy Lawyer contact us today at 313-982-0010!

Affordable Bankruptcy Lawyers

We Meet Or Beat The Lowest Attorney Fee You Can Find!

Chapter 7 bankruptcy is designed to help individuals and/or small businesses liquidate assets and repay creditors to resolve longstanding financial disputes. This is the type of bankruptcy usually best suited to a person who has a modest income, few assets, and comparatively high debts.

During a Chapter 7 Bankruptcy proceeding, about a month after you file the case in Michigan, there is a meeting of the creditors (341 Hearing) – however, it is rare that creditors actually show up for this meeting. This meeting lasts about five to ten minutes. Three to six months later, you receive notice that your debts are discharged.

If you are looking to file a Chapter 7 Bankruptcy in Michigan with an experienced low cost bankruptcy attorney that will save you money, call us today for a FREE phone consultation at 313-982-0010.If you are looking to file a Chapter 7 Bankruptcy in Michigan with an experienced bankruptcy attorney that will save you money, call us today for a FREE phone consultation at 313-982-0010.

Are you considering filing for bankruptcy? We are one of the law offices in the Detroit metro area to offer a guarantee of your unsecured debt discharge (cancelled). If the court does not grant your discharge, we will refund the attorney’s fees you paid to us. The only requirements for you are that you disclose everything and tell the court the truth.

FREE Consultation

Your Road to a Fresh Financial Start Begins Here!

We are here to get you out of debt, eliminate stress and get the fresh start that you deserve.

Wage Garnishment? We can stop that.

Bankruptcy immediately ends most wage garnishments. When a bankruptcy petition is filed with the court, an "automatic stay" against collection effort goes into immediate effect.

Frozen Bank Account? We can help.

Certain funds are either partially or fully exempt from execution to satisfy an outstanding judgment under federal or Michigan law.

We Meet Or Beat The Lowest Attorney Fee You Can Find!

** If we make a mistake in your bankruptcy petition that leads to you not receiving a discharge in your bankruptcy case we will refund you 100% of the attorney fees. We reserve the right to do whatever is possible to address any issue that may arise in your case at our own expense. We are not guaranteeing you a result in your bankruptcy case or that you will receive a discharge of all of your debts or any one debt. There are debts that are not dischargeable pursuant to the Bankruptcy Code. Your bankruptcy case may also involve litigation that is independent of you receiving a discharge in your bankruptcy case. We cannot guarantee that that you will obtain a discharge of any one specific debt, or of all debts.

Detroit

18551 W. Warren Ave.,

Detroit, MI. 48228

(313) 982-0010

Southfield

24300 Southfield Rd, Ste 210

Southfiled, MI. 48075

(248) 281-6299

1-248-281-6299

Have Your Creditors Calling Us, Not You

Retaining a bankruptcy lawyer is one of the best and easiest ways to stop creditors from calling you. The FDCPA requires all creditors to speak to your lawyer instead of calling you at home, at work or on your cellphone. Filing a bankruptcy petition will also prohibit them from harassing you.

Federal laws (FDCPA) places lot of restrictions on creditors and debt collectors. Among other things, they are not allowed to:

Call you before 8 in the morning or after 9 at night

Call you at work if your supervisor disapproves

Make threats against you or your family

Use obscene language

Fail to identify themselves on the phone

We Serve Detroit, Wayne County, Oakland County & Macomb County Areas

BankruptcyMax.com and Bankruptcymax.org are owned and operated by Advanta Law Firm with two Locations Detroit & Southfield, MI., delivers chapter 7 bankruptcy filing services for in the city of Detroit & surrounding areas including Inkster, Dearborn, Dearborn Hts, Hamtramck, Michigan. Our bankruptcy attorneys are also familiar with customers experiencing hardship related to Job loss or income reduction, an illness or injury that prevents you from working, divorce or separation, the death of a spouse or family member, and medical debt can all cause you to be unable to make your mortgage payments and take care of other important financial obligations and in need of assistance including file bankruptcy. We understand that many people are considering filing bankruptcy whether chapter 7 or 13, if they are tried to work with mortgage company and lenders are not willing to help. We offer cheap & affordable at affordable low flat fees and payment plans. Your case handled directly by an experienced chapter 7 bankruptcy attorney. We file bankruptcy in United States Bankruptcy Court in Detroit, MI. We handle bankruptcy cases from drafting petition, file bankruptcy, appear for 341 hearing, meet with trustee, and get a bankruptcy discharged. Serving Detroit, Southfield, Oakland, Macomb, Royal Oak, Warren, Livonia, Canton, Ypsilanti and surrounding areas. If you need help filing and would like to get information on bankruptcy, we offer free Case Evaluation. Call our Detroit,MI., bankruptcy lawyer. At our firm we strive to make access to legal representation affordable to all. Our fees for a Chapter 7 cases will start at $499.00, with affordable payment plans available to fit any budget

Our bankruptcy lawyer is helping people struggling with credit card debt and any debts that have a serious consequence like being evicted or getting a court lawsuit. Call our Detroit bankruptcy lawyer for a free advice. If you would like to file bankruptcy in Detroit, we offer the lowest legal fees for bankruptcy filing services.

The moment your Detroit chapter 7 bankruptcy or Detroit chapter 13 bankruptcy is filed with the bankruptcy court in Detroit by one of our affordable Detroit bankruptcy lawyers, the protective measures of bankruptcy become effective. These protective measures also known as the “automatic stay” instantly take effect. With an Automatic Stay through filing for bankruptcy in Detroit, MI, all garnishments will cease, collection actions against you must stop as creditors will be forbidden from attempting to collect debts. Bankruptcy’s automatic stay can prevent repossession, foreclosure, garnishment, tax levy, eviction, utility shutoff or a lawsuit.

If you find yourself in a tough financial position and can’t see a way out, meet with our Detroit experienced bankruptcy attorney today.

What Happens If You File For Bankruptcy?

After filing for bankruptcy, you or your lawyer must provide the bankruptcy trustee tax returns, paystubs if you get them, and any other documents requested.

And you must appear at the first meeting of creditors. You must bring to the meeting proof of your identity in the form of government-issued picture ID and proof of your social security number. At the meeting, the trustee or some time your creditor will ask you questions. Meeting usually will take between 5-10 min.

Creditors or the bankruptcy trustee can contest your discharge if they can prove you lied on your schedules or otherwise treated creditors or the bankruptcy system unfairly. If you need to file bankruptcy, we can help you get out of debt and start fresh.

| ||||

| ||||

What Bankruptcy Can Do For Me?

Would I Lose All My Assets If I File For Bankruptcy?

You don't have to lose your assets when you file for bankruptcy

Over 20 Years of Experience | Locally Owned | Same-Day Appointments

Filing for bankruptcy can lead to discharging your debt.The bankruptcy process in bankruptcy court has changed in recent years, requiring more documentation and other form requirements. Moving forward with a bankruptcy filing demands absolute accuracy. We can help ensure that every aspect of your filing is correct to ensure that you have the opportunity to become free of consumer debt through Chapter 7 of the bankruptcy code. Our law firm can assist you in putting an end to any of the following:

Repossessions

Wage Garnishment

Foreclosures

Collection Lawsuits

| ||||

Chapter 7 Bankruptcy Can Eliminate

Almost All Types Of Debt, In About

3 Months

• Force creditors to return garnished money

• Stop wage, tax refund and bank garnishments

• Stop foreclosure and eviction

• Stop repossession and seizure

• Stop collection calls and letters

• Stop lawsuits

• Stop utility shut off and restore service

• Eliminate IRS tax debt, if eligible

When filing for Chapter 7 bankruptcy in Michigan, many people wonder whether they will lose their car, home, bank accounts and more. The purpose of bankruptcy is to help people get back on their feet and regain control of their financial situation. Chapter 7 bankruptcy exemptions protect the day-to-day property that will be excluded from your bankruptcy filing.

Under bankruptcy “exemptions” you will get to to keep your exempted assets. If a property is not exempt, then it means that your bankruptcy trustee can sell it and divide the profit among your creditors. Call us if you have questions.

Living a Life of Fear of Creditors

Losing Sleep Over Debt!

Let Us Help You & Take Care of You!

Name:

Phone

Email:

Massage:

Of Chapter 7 Bankruptcy In Detroit Metro Area Since 1998

1-248-281-6299

The Benefits of

Bankruptcy

Bankruptcy can give you a fresh start by eliminating the legal requirement to pay your debts and stopping creditors from harassing you.

What Debts Can

Be Eliminated?

Chapter 7 bankruptcy can eliminate most debts, including credit card debt, bank loans, medical bills, pay-day loans, and old utility bills.

How Much Does

Bankruptcy Cost?

Take advantage of our free initial consultations to sit down with our experienced attorneys for bankruptcy evaluation. Consultation can be over the phone or in person. We charge a flat rate fee to all of our clients. No assets chapter chapter 7 bankruptcy starting at $499.00. For more information call us at (248) 281-6299. During COVID-19, your bankruptcy can be processed in our office while your in home.

1-248-281-6299

1-248-281-6299